Introduction

If you’re working a minimum wage job, it can be hard to make ends meet. But there are ways to save money even on a tight budget. Check out these tips on how to save money on low-income minimum wage.

Why is it important to save money?

Saving money is important for everyone, but it can be especially difficult for those who are living on a low income. Minimum wage jobs often don’t pay enough to cover all of the necessary expenses, which can make it difficult to put any money away for savings. However, there are some things that you can do in order to make saving easier.

One thing that you can do is to create a budget. Knowing how much money you have coming in and where it all needs to go can help you to make better decisions about your spending. There may be some areas where you can cut back in order to free up more money for savings.

Grow Your Small Channel Using AI Tools

Another helpful tip is to set up a direct deposit into your savings account. This way, you’ll never even see the money and it will automatically be going into your savings. Even if it’s just a few dollars each week, it will start to add up over time.

If you are able to save even a small amount of money each month, it can make a big difference down the road. It may not seem like much now, but over time those savings will start to add up and give you a cushion in case of an emergency. You could also consider implementing some frugal living hacks that will save you thousands, which have become a necessity for many, especially in an era where financial freedom feels elusive.

Cut back on unnecessary expenses

If you’re working a low income job, chances are that you’re living paycheck to paycheck. This can make it difficult to save money, but it’s not impossible. One way to start saving is by cutting back on unnecessary expenses.

Do you really need that $5 latte every morning? Could you pack your lunch instead of eating out? Little changes like this can add up over time and help you start saving for your future.

Switch to Vanlife

Hey there! If you’re looking to save money on a low income, one option you might want to consider is vanlife. It’s not for everyone, but if you can make it work, it can be a great way to save money on rent and other living expenses. Here are a few tips on how to make the switch to vanlife:

1. Start by purging your belongings. You won’t have a lot of space in your van, so you’ll need to be selective about what you bring with you. Only keep the essentials and get rid of anything else.

2. Find free or cheap places to park overnight. You can usually find free parking in Walmart parking lots or other large retail stores. Just be sure to check with the store first to make sure they’re okay with it.

3. Get creative with your cooking. Since you’ll have limited space and resources, you’ll need to get creative with your cooking. One option is to invest in a small portable stove that you can use for cooking simple meals.

4. Make use of public showers and restrooms. When you’re living in a van, you won’t have access to a private bathroom. However, most gy

Work for companies that give free food

There are a number of ways to save money on a low income, but one often overlooked method is to work for companies that give free food. Many restaurants and cafes offer their employees free or discounted meals, and this can be a great way to save money on food costs. Additionally, some companies offer employee discounts at local grocery stores, which can also help to reduce your overall food budget.

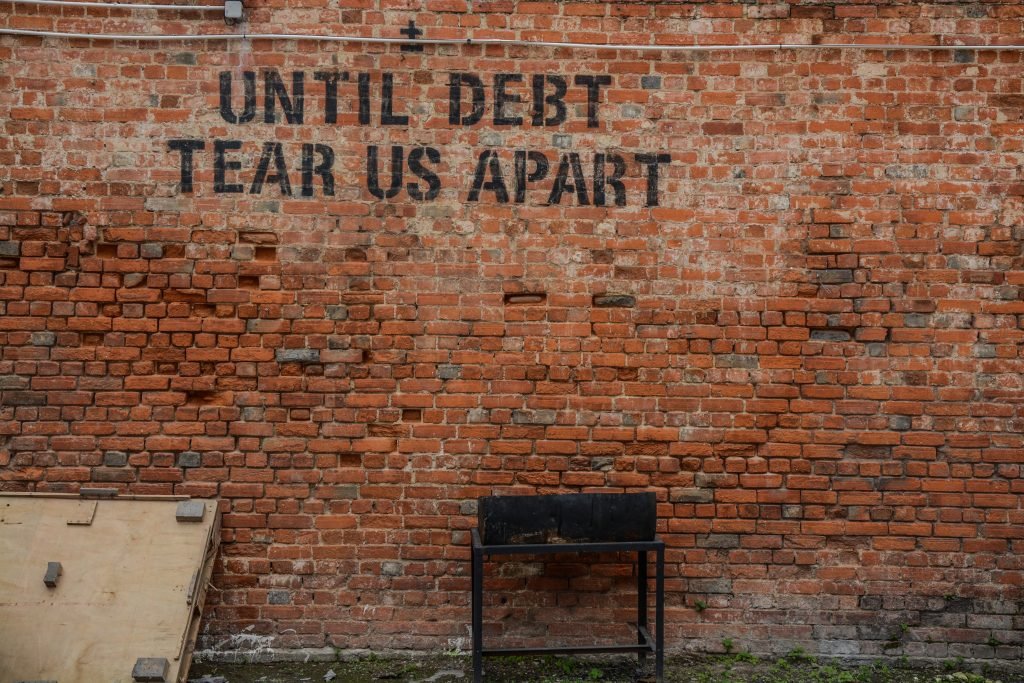

Pay off all of your debt

If you’re like most people, you probably have some debt that you’re working on paying off. But did you know that if you’re on a low income or minimum wage, there are some extra steps you can take to pay off your debt faster?

One way to do this is to make biweekly payments instead of monthly payments. This will help you reduce the amount of interest you’re paying, and it will also help you get out of debt faster.

Another way to speed up the process of paying off your debt is to target the debts with the highest interest rates first. This will save you money in the long run, and it will also help you get out of debt faster.

If you’re on a low income or minimum wage, there are some extra steps you can take to pay off your debt faster. By making biweekly payments and targeting debts with high interest rates first, you can save money and get out of debt sooner.

Invest in yourself by learning a new skill

There are a lot of ways to save money, but one of the best ways is to invest in yourself by learning a new skill. Not only will this help you save money in the long run, but it can also help you improve your career prospects and earnings potential.

There are plenty of free or low-cost ways to learn new skills these days, so there’s no excuse not to invest in yourself. You could take an online course, read books or blog posts on the subject, or even find a mentor who can teach you what you need to know.

Don’t forget that saving money is only half the battle – you also need to make sure that you’re earning enough to meet your needs. So if you’re looking for ways to boost your income, learning a new skill could be the answer.

Conclusion

There are a number of ways to save money on a low income, even if you are working minimum wage. By following some simple tips and tricks, you can make your money go further and stretch your budget a little bit further. Try out some of the ideas in this article and see how much you can save. You may be surprised at how quickly the savings add up.